London 5 th October 2021 : IPOSUP.COM app is a holistic financial services platform for micro-merchants, providing mobile card and bank payments at the point-of-sale and giving businesses and their staff bank accounts in

minutes.

Opening up a traditional bank account for a small business can be extremely challenging with increased credit and anti-money laundering (AML) checks, specific requirements and lengthy verification processes. It can take several weeks to set up a business account with traditional UK clearing banks.

The banking space is therefore seeing a shift away from traditional banking methods, towards neobanks, which are ‘challenging’ traditional players with high levels of transparency and easy registration. However, many of these online banks charge monthly subscription as well as transaction fees for business banking. Unlike most major competitors, IPOSUP provides absolutely free business bank accounts with no hidden charges for micro-sellers signing-up for card and bank payments acceptance, along with a plethora of exciting features designed specifically for small businesses.

Registration to the IPOSUP app takes approximately 15 minutes and is highly secure, using strong two factor customer authentication (SCA). This saves merchants the hassle of going into a traditional bank and waiting weeks to be verified and sent bank details.

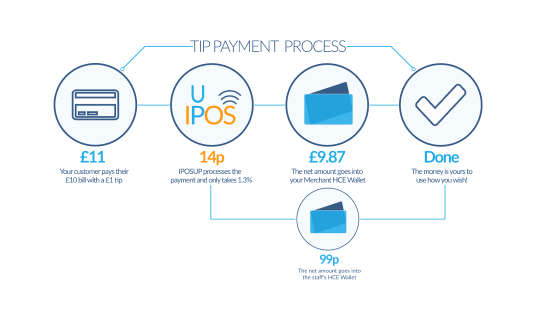

Merchants can also take payments using IPOSUP, through the IPOS bric, IPOS pad and IPOS soft card readers, at rates which are 25% cheaper than their competitors Zettle, Square and Sumup, saving money with every transaction. Moreover, IPOSUP has incorporated charity

Donation and gratuity features, giving sellers the option to enhance their ESG values. Finally, the launch of the IPOSUP financial services has come at an ideal time with the expected change in legislation by the UK Government, that will make it illegal to withhold gratuities (tips) from staff.

Dr Chandra Patni, CEO of IPOSUP.COM said “The number of micro and small businesses has grown to over 5 millions after the COVID-19 pandemic and subsequent lockdown measures. As an entrepreneur myself, I understand that its not easy for start-up business owners to sort out their banking and payments requirements at a time when they have a lot on their plate. IPOSUP collates banking, payments and ESG all into one unique, fast and simple and

transparent mobile application”.

ABOUT IPOSUP

Owned and operated by HCE Service Ltd, IPOSUP is a mobile card and bank payments service aimed at micro- and small- businesses throughout UK and in the future Europe with the aim that their smartphones downloaded with the mobile IPOSUP app can process chip and PIN, contactless NFC and remote card and bank payments.

IPOSUP state-of-the-art hosted infrastructure provides high-availability 24-7 FCA regulated (FCA Number 931781), PCI-DSS Level-1 card and bank payments processing services.

IPOSUP integrates strong digital ID security for Users on their mobile devices. IPOSUP MAP (Mobile Application

Platform) UK data centres provide advanced banking Faster Payments and Visa/Mastercard cards

payments processing services.

For more information, visit:

https://iposup.com and https://hceservice.com,

HCE Service Limited, 8 The Drive, New Barnet, Hertfordshire, EN5 1DZ, UK,

sales@hceservice.com, support@hceservice.com

Phone support: +44 7535410101.